Rent Calculator Based on Income: Optimize Your Budget

Looking to find the perfect housing budget? Curious about how much you should allocate for rent based on your income?

Our rent calculator analyzes your earnings to provide personalized recommendations. Discover the ideal housing budget for you and make informed decisions.

What Is Rent Calculator Based On Income? A Rent Calculator Based on Income is a tool that helps individuals determine how much rent they can afford based on their income.

It takes into account the person’s gross income and monthly expenses to provide an estimate of the maximum rent they can comfortably pay each month.

The calculator divides the net income into different ranges, such as low, mid, and high, which represent the amount of rent that can be afforded based on different percentages of the income.

rent affordability calculator Based On Income

Rent is one of the most significant expenses in our monthly budget. It’s crucial to balance the cost of rent with other financial obligations, such as food, transportation, healthcare, and savings.

To help you navigate this critical aspect of personal finance, we’ve developed a rent calculator based on your income.

This tool will provide you with a range of rent payments suitable for your income level, helping you make informed decisions about your housing budget.

How to Use the Rent Calculator

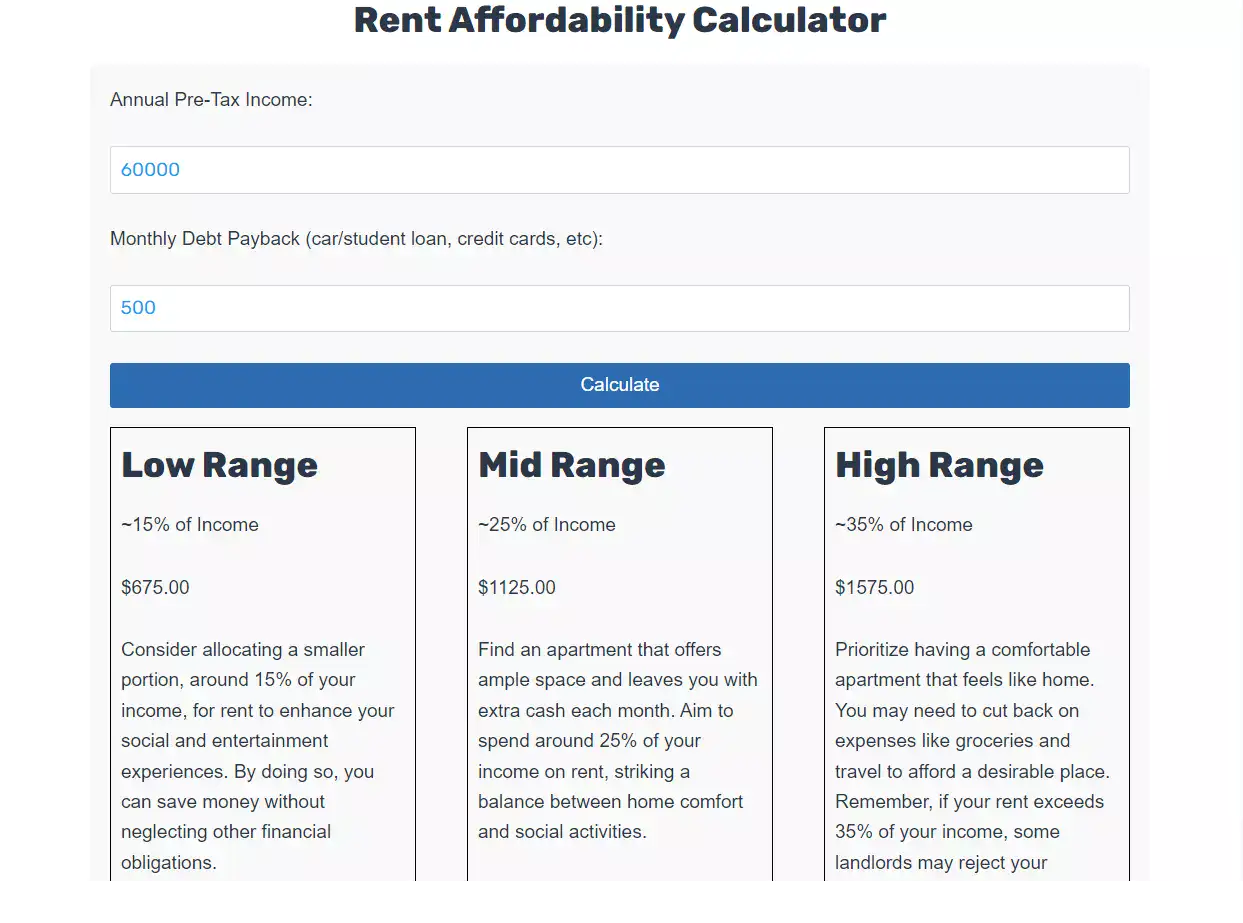

Using the rent calculator is straightforward. First, input your annual pre-tax income in the appropriate field.

Next, enter your monthly debt payments, such as car or student loans and credit card payments. Click “Calculate,” and the calculator will display your rent ranges.

Each range comes with a brief explanation, guiding you on how to interpret the results.

For instance, the low range suggests allocating a smaller portion of your income to rent, allowing you to save money for other financial obligations or social activities.

The mid-range strikes a balance between home comfort and other expenses, while the high range prioritizes a comfortable living space but may require cutting back on other expenses.

Why Should You Use a Rent Affordability Calculator?

The rent calculator is like a magic tool. It helps you see how much money you should spend on rent. Let’s explore why it’s so useful.

Helps You Plan Your Budget

First, the rent calculator helps you plan your budget. It’s like a roadmap for your money.

You enter your income and your debts. Then, the calculator tells you how much you can afford to spend on rent.

It gives you three options: low, mid, and high range. This way, you can choose what works best for you.

Prevents Overspending

Second, the rent calculator stops you from spending too much on rent. Imagine you see a cool apartment.

You love it, but it’s expensive. The rent calculator can tell you if it’s too pricey for your budget. It’s like a friend who gives you good advice.

Helps You Save Money

Third, the rent calculator can help you save money. Let’s say you choose the low range option.

This means you spend less on rent. Now, you have extra money for other things.

You can save it, or spend it on fun activities. It’s like having a piggy bank that keeps growing.

Makes Renting Easier

Lastly, the rent calculator makes renting easier. It’s like a guide that leads you through the renting process.

It helps you understand how much you can afford. This way, you can find a home that fits your budget. It’s like finding the perfect puzzle piece that fits just right.

Factors to Consider When Determining Rental Costs

1. Location:

The location of a rental property is an essential factor in determining its rental cost.

Properties located in popular or desirable areas, such as close to schools, parks, or commercial centers, tend to have higher rental prices.

On the other hand, properties in less desirable or remote locations may have lower rental costs.

Consider the neighborhood’s amenities, accessibility, and overall demand when evaluating the location’s impact on rental costs.

2. Property Type:

The type of property you are renting also influences the rental cost.

Different types of properties, such as apartments, houses, or condominiums, have varying rental rates based on factors like size, layout, and available amenities.

For example, a larger house with multiple bedrooms and bathrooms will generally command a higher rental price compared to a smaller apartment unit with fewer amenities.

3. Property Size:

The size of a rental property directly affects its rental cost. Typically, the larger the property, the higher the rental price.

Property size is often measured in terms of square footage or the number of bedrooms and bathrooms.

Larger properties provide more living space, storage, and privacy, which makes them more attractive to potential tenants and justifies a higher rental cost.

4. Condition and Age:

The condition and age of the rental property can influence its rental cost.

Well-maintained and updated properties with modern features and amenities usually command higher rental prices.

Newer properties or those recently renovated often have higher rental costs due to the appeal of newer fixtures, appliances, and overall aesthetics.

Older or less maintained properties may have lower rental costs, but it’s crucial to balance cost savings with the potential maintenance or repair expenses.

5. Market Demand:

The supply and demand dynamics of the rental market play a significant role in determining rental costs.

In areas with high demand and limited supply of rental properties, landlords can set higher rental prices.

Conversely, in areas where rental vacancies are high or there is an oversupply of rental units, landlords may need to lower rental prices to attract tenants.

Stay informed about the local rental market and consider factors such as job growth, population trends, and the availability of comparable rental properties.

6. Utilities and Additional Expenses:

When determining rental costs, it’s important to consider additional expenses beyond the base rent.

Some rental properties include utilities such as water, electricity, or internet in the rental price, while others require tenants to pay for these separately.

Additionally, consider factors like parking fees, maintenance fees, or HOA (Homeowners Association) fees that may impact the overall rental cost.

Be sure to account for these additional expenses to get an accurate picture of the total cost of renting a property.

7. Rental Terms and Lease Length:

The rental terms and lease length can also influence the rental cost.

Short-term rentals or month-to-month leases generally have higher rental prices compared to long-term leases.

Landlords may offer discounts for tenants who sign longer lease agreements, such as one or two years.

Consider your flexibility and requirements when deciding on the lease length and factor in the associated costs.

8. Tenant Screening and Background Checks:

Landlords often conduct tenant screening and background checks to ensure they are renting to responsible and reliable tenants.

These checks may include credit history, employment verification, and rental references.

The time and effort invested in tenant screening and background checks contribute to the overall cost of renting a property.

While this may not directly impact the rental price, it is a factor to consider in terms of the overall rental process.

How Can You Save Money on Rent?

Negotiate Rent with Your Landlord

When it comes to saving money on rent, negotiating with your landlord can be a helpful strategy.

Start by researching the current rental prices in your area to gather evidence for negotiation.

Approach your landlord in a polite and respectful manner, expressing your interest in renewing your lease while discussing the possibility of a rent reduction.

Highlight your good track record as a tenant, emphasizing your on-time payments and responsible behavior. Propose a reasonable rent reduction based on the market prices you’ve gathered.

Be open to compromises and consider suggesting a longer lease term or offering to take care of certain maintenance tasks yourself to sweeten the deal.

Remember to document any agreements in writing and ensure both parties sign the updated lease agreement.

Consider Sharing a Rental Space

Sharing a rental space with a roommate or housemate can significantly reduce your monthly rent expenses.

Start by discussing the idea with friends, family, or trusted acquaintances who may be interested in sharing a living space. Set clear expectations and preferences regarding shared responsibilities, privacy boundaries, and financial obligations.

Once you find a suitable roommate, search for rental properties that can accommodate multiple tenants.

Consider the location, amenities, and affordability of the potential shared space. Make sure to review the lease agreement together, clarifying each tenant’s responsibilities and the procedures for handling any conflicts that may arise.

By sharing a rental space, you can split the rent and utilities, allowing you to save money while enjoying the benefits of companionship and shared expenses.

Explore Alternative Rental Options

To save money on rent, consider exploring alternative rental options beyond traditional apartments or houses.

Look for rental units in converted spaces such as basement apartments or garage conversions, which are often priced lower than standard apartments.

Another option is renting a room in someone else’s house or apartment. This arrangement can be cost-effective, especially if you’re comfortable with sharing common areas and living with the homeowner or other tenants.

Additionally, you may consider house-sitting or becoming a property caretaker, which can provide you with a place to live at a reduced cost or even for free in exchange for maintaining the property.

By being open to alternative rental options, you can find unique and affordable living arrangements that fit your budget.

Save on Utilities

Saving money on utilities can contribute to overall cost savings on your rental expenses.

Start by practicing energy-saving habits such as turning off lights and appliances when not in use and using natural light whenever possible. Consider replacing traditional incandescent light bulbs with energy-efficient LED bulbs.

Adjust your thermostat to optimize energy usage, keeping it slightly lower during the winter and higher during the summer. Use weatherstripping and insulation to prevent drafts and maintain a comfortable indoor temperature.

Be mindful of water consumption by taking shorter showers and fixing any leaks promptly.

Finally, compare utility providers in your area to ensure you’re getting the best rates for electricity, water, and internet services. By implementing these energy-saving measures, you can reduce your monthly utility bills and save money in the long run.

FAQs

1. What is a Rent Calculator Based on Income?

A Rent Calculator Based on Income is a tool that helps you determine how much rent you can afford based on your income. It takes into account your gross income and monthly expenses to provide an estimate of the maximum rent you can comfortably pay each month.

2. How Does a Rent Calculator Based on Income Work?

The Rent Calculator works by taking your gross income and subtracting your monthly expenses. It then divides this net income into three categories: low, mid, and high range. These ranges represent the amount of rent you can afford based on different percentages of your income.

3. How Accurate is the Rent Calculator Based on Income?

The Rent Calculator provides a good estimate of what you can afford, but it’s important to remember that it’s just a guideline. Your actual budget may vary based on other factors such as your lifestyle, financial goals, and the cost of living in your area.

4. Can I Use the Rent Calculator if I Have Roommates?

Yes, you can use the Rent Calculator if you have roommates. Each roommate can input their income and expenses to determine what they can afford. Then, you can add up everyone’s maximum rent to determine the total rent the household can afford.

5. What Other Factors Should I Consider When Determining How Much Rent I Can Afford?

In addition to your income and monthly expenses, you should also consider factors like the cost of utilities, transportation costs, insurance, and other living expenses. Also, consider the location of the property, the cost of living in the area, and the potential for rent increases in the future.

[tta_listen_btn]