Welcome To Rental Awareness.com

Know More. Live Better

Our Latest Guides

22 Creative Ways to Display Your Favorite Photos at Home

Your favorite memories deserve to be showcased in style throughout your home. From Instagram prints to family portraits, there are countless creative ways to turn…

15 Retro Bedroom Ideas That Scream Pure 80s Nostalgia

You don’t have to love minimalism to create a stunning bedroom that feels fresh and current. The 1980s brought us incredible design elements that are…

70 Creative Home Office Ideas to Design Your Perfect Workspace

Creating the perfect home office isn’t just about finding a desk and chair anymore. You need a space that inspires productivity, reflects your personal style,…

9 Creative Ways to Transform Your Garage Into Beautiful Living Spaces

Your garage holds incredible potential beyond just storing cars and clutter. With some creativity and planning, you can transform this overlooked space into a stunning…

85 Stunning Primary Bedroom Design Ideas to Transform Your Space

Your primary bedroom should be the ultimate sanctuary where you retreat, recharge, and dream. Whether you’re craving coastal vibes, modern minimalism, or cozy farmhouse charm,…

40 Stunning Entryway Lighting Ideas That Will Transform Your Home’s First Impression

Your entryway sets the tone for your entire home, and the right lighting can make all the difference between a welcoming space and one that…

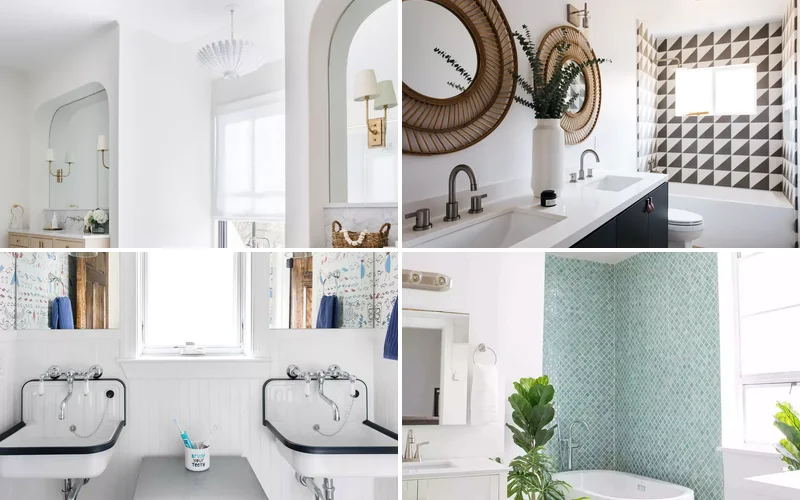

102 Stunning Bathroom Design Ideas That Will Transform Your Space

Ready to turn your bathroom into the sanctuary you’ve always dreamed of? These 102 incredible design ideas will inspire you to create a space that’s…

72 Contemporary Bedroom Design Ideas That Transform Your Space

Ready to turn your bedroom into a sleek, modern sanctuary that feels like a high-end hotel suite? You’re in for a treat with these 72…

25 Bathroom Mirror Ideas That Make Any Space Feel Massive

You’re about to discover how the right mirror can completely transform your bathroom from cramped to spacious. Whether you’re working with a tiny powder room…