Welcome To Rental Awareness.com

Know More. Live Better

Our Latest Guides

25 Bedroom Accent Wall Ideas That Completely Transform

You’re staring at your bedroom walls wondering how to make them more exciting without breaking the bank. An accent wall is your perfect solution –…

15 Stunning Midcentury Modern Tile Designs That Will Transform Your Home

Ready to bring some serious retro charm into your space? Midcentury modern tiles are making a major comeback, and honestly, we’re here for it. These…

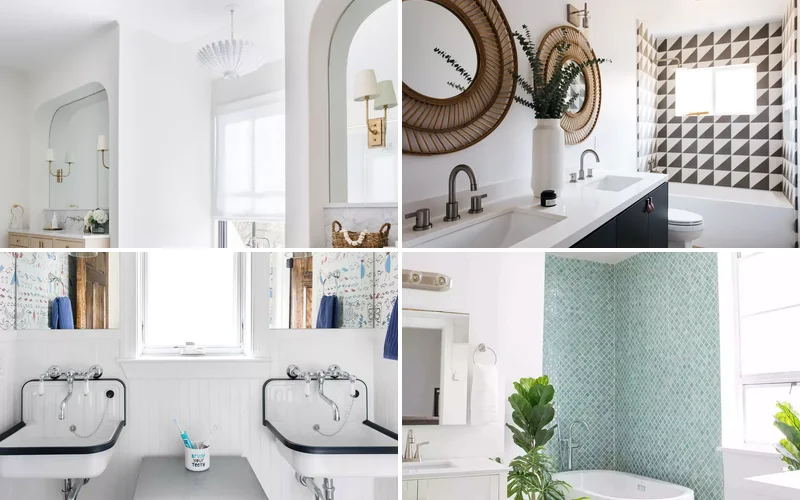

102 Stunning Bathroom Design Ideas That Will Transform Your Space

Ready to turn your bathroom into the sanctuary you’ve always dreamed of? These 102 incredible design ideas will inspire you to create a space that’s…

39 Stunning Front Door Decor Ideas to Welcome Every Season

Your front door is the first thing guests see when they visit your home, making it the perfect opportunity to showcase your personal style. Whether…

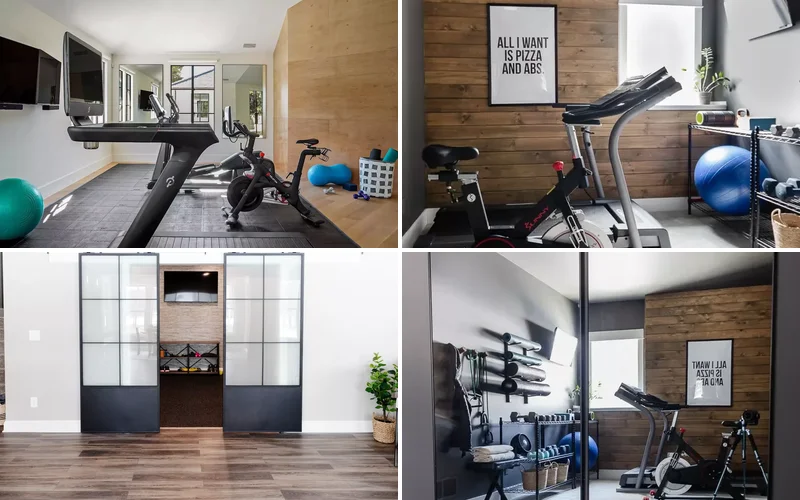

37 Inspiring Home Gym Design Ideas That’ll Transform Your Workout Space

Creating a home gym doesn’t mean sacrificing style for function. Whether you’re converting a spare bedroom, basement, or carving out a corner in your living…

28 Brilliant Ways to Transform Your Workspace Into an Organized Haven

Your desk doesn’t have to be a chaotic mess that makes you cringe every morning. With the right organizing strategies, you can create a workspace…

70 Creative Home Office Ideas to Design Your Perfect Workspace

Creating the perfect home office isn’t just about finding a desk and chair anymore. You need a space that inspires productivity, reflects your personal style,…

15 Tiny Nursery Ideas That Maximize Small Spaces

Creating the perfect nursery in a small space doesn’t have to feel overwhelming or impossible. You can absolutely design a beautiful, functional room for your…

32 Modern Farmhouse Dining Room Ideas That Bring Rustic Warmth to Your Home

You’re about to discover how modern farmhouse style can transform your dining room into the perfect blend of rustic charm and contemporary elegance. These inspiring…