How Much Rent Can I Afford? Rental Awareness

Discovering the right rental that doesn’t break the bank yet aligns with your lifestyle can be like finding a needle in a haystack.

This guide unravels the complexity behind determining how much rent you can afford, ensuring your next move is a financially savvy one.

How to Calculate How Much Rent You Can Afford

Determining your rental affordability is as easy as following the 30/50/20 rule; allocate 30% of your income to rent, 50% to necessities, and 20% to savings. In a nutshell, keep your rent within 30% of your monthly income.

The 30/50/20 budgeting rule is a simple yet effective guideline to not only manage your rent but also balance your essential expenses and savings.

SHOCKING: 2025 MacBook Air M4 STILL at insane Prime Day price – $150 OFF but this deal could vanish ANY SECOND!

By adhering to this rule, you establish a financial framework that supports a stable living situation and future financial security.

The 30% portion dedicated to rent is designed to prevent you from living paycheck to paycheck, a scenario nobody wants to find themselves in.

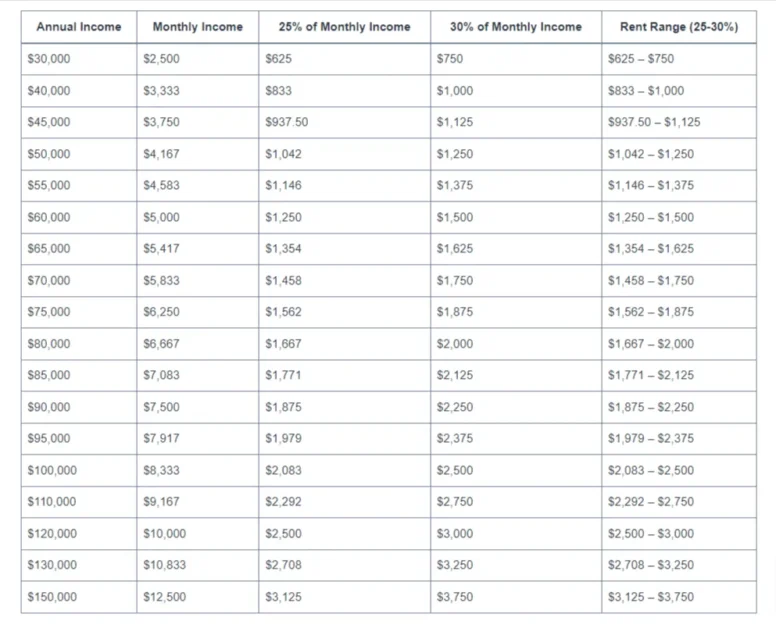

Rent Affordability Chart

| Annual Income | Monthly Income | 25% of Monthly Income | 30% of Monthly Income | Rent Range (25-30%) |

|---|---|---|---|---|

| $30,000 | $2,500 | $625 | $750 | $625 – $750 |

| $40,000 | $3,333 | $833 | $1,000 | $833 – $1,000 |

| $45,000 | $3,750 | $937.50 | $1,125 | $937.50 – $1,125 |

| $50,000 | $4,167 | $1,042 | $1,250 | $1,042 – $1,250 |

| $55,000 | $4,583 | $1,146 | $1,375 | $1,146 – $1,375 |

| $60,000 | $5,000 | $1,250 | $1,500 | $1,250 – $1,500 |

| $65,000 | $5,417 | $1,354 | $1,625 | $1,354 – $1,625 |

| $70,000 | $5,833 | $1,458 | $1,750 | $1,458 – $1,750 |

| $75,000 | $6,250 | $1,562 | $1,875 | $1,562 – $1,875 |

| $80,000 | $6,667 | $1,667 | $2,000 | $1,667 – $2,000 |

| $85,000 | $7,083 | $1,771 | $2,125 | $1,771 – $2,125 |

| $90,000 | $7,500 | $1,875 | $2,250 | $1,875 – $2,250 |

| $95,000 | $7,917 | $1,979 | $2,375 | $1,979 – $2,375 |

| $100,000 | $8,333 | $2,083 | $2,500 | $2,083 – $2,500 |

| $110,000 | $9,167 | $2,292 | $2,750 | $2,292 – $2,750 |

| $120,000 | $10,000 | $2,500 | $3,000 | $2,500 – $3,000 |

| $130,000 | $10,833 | $2,708 | $3,250 | $2,708 – $3,250 |

| $150,000 | $12,500 | $3,125 | $3,750 | $3,125 – $3,750 |

This table allows for a quick reference to understand the range of rent one could afford based on various annual income levels.

Factors Influencing Rent Affordability

1. Income Levels

Your income is the cornerstone of your rental affordability. It sets the stage for what you can realistically afford without stretching your wallet too thin.

Delve into your monthly earnings, and don’t forget to account for any additional income sources which can paint a more accurate picture of your financial landscape.

2. Monthly Expenses

Monthly expenses go beyond just rent. They encompass utilities, groceries, transportation, and even your morning coffee.

Getting a handle on your monthly outgoings gives you a clearer perspective on how much rent you can comfortably afford while maintaining your current lifestyle.

3. Debt Obligations

Debts are like that uninvited guest at a party—they tend to hang around longer than you’d like.

Your existing debt obligations, whether they are student loans, credit card payments, or personal loans, significantly impact how much you can allocate towards rent.

4. Savings and Financial Goals

We all have dreams, and often, they come with a price tag.

Whether you’re saving for a vacation, a new car, or a home, your financial goals need to be factored into your rent affordability equation.

Balancing between paying rent and saving for your goals is a tightrope walk, yet utterly crucial.

Tools and Resources for Calculating Rent Affordability

1. Online Rent Calculators

Our website offers specialized online rent calculators that give you a tailored estimate of the rent you can afford.

Unlike generic calculators, ours take into account different factors to provide a more accurate figure.

- Rent Calculator Based on Hourly Wage: This calculator is perfect for individuals earning an hourly wage. It computes your affordable rent range based on your hourly wage, hours worked per week, and other expenses.

- Rent Calculator Based on Income: If you have a fixed monthly or annual income, this calculator is for you. It determines the rent you can comfortably afford by examining your income and monthly expenses.

Utilizing these calculators can give you a clearer insight into your rental affordability.

They are user-friendly and tailored to provide a more personalized estimation.

Remember, having a realistic budget is the first step towards finding the right home within your means.

2. Financial Advisors

If you’re looking for personalized advice, consulting a financial advisor is a wise choice.

They can provide a tailored assessment of your financial situation and guide you on the rent you can afford while still meeting your other financial obligations and goals.

3. Budgeting Apps

In today’s digital age, budgeting apps are a lifesaver. They help you track your income, expenses, and even suggest a rent budget based on your financial behavior.

Plus, they offer the added advantage of having all your financial information in one place, making rent affordability calculations a breeze.

Tips for Making Rent More Affordable

Understand Your Budget

First, know your budget. Look at your income. Then look at your expenses. Subtract your expenses from your income.

The result is your budget for rent. Make sure you have a clear understanding of your financial situation.

This step is vital. It helps you know what you can afford. It also guides your decisions.

Consider the Location

Location affects rent. Areas closer to the city are expensive. Areas farther from the city are cheaper.

Consider moving to a less expensive area. Research different areas. Look at the cost of living.

Look at the commute time too. Find a balance that works for you. This way, you can save on rent.

Roommates Can Help

Having a roommate can lower your rent. They share the cost with you. Find a roommate who is reliable.

Make sure they can pay their share on time. Also, make sure you get along well. Living with a roommate can be a big change. It can help make rent more affordable though.

Negotiate the Rent

Try to negotiate the rent with the landlord. Show them you are a good tenant. Pay your rent on time.

Keep the property clean. Sometimes, landlords lower the rent for good tenants. It’s worth a try. It can save you money every month.

Look for Included Utilities

Some places include utilities in the rent. This can save you money. Look for places that include heat, water, and electricity.

It’s a good way to keep costs down. It’s also simpler. You pay one bill instead of many.

Downsize

Consider downsizing. Look for a smaller place. Smaller places usually cost less. Make sure it still meets your needs.

It’s a trade-off. You get less space but save money. It’s an important consideration.

Research and Compare

Always research and compare different places. Look at the cost. Look at what’s included.

Compare different neighborhoods. This helps you find the best deal. It’s a smart way to save on rent.

Apply for Housing Assistance

If eligible, apply for housing assistance. There are programs that can help. They lower your rent based on your income.

Look into local and federal programs. See if you qualify. It can provide significant savings.

Here Is Individual Rent Affordability Guides On Income

How Much Rent Can You Afford On 30k

If you make 30k annually, it’s wise to allocate between $625 to $750 per month for rent, adhering to the recommended 25-30% of income towards housing expenses guideline.

How Much Rent Can You Afford On 40k

With a 40k annual income, a monthly rent budget between $833 to $1,000 is reasonable, following the commonly advised 25-30% of income for housing expenditure guideline.

How Much Rent Can You Afford On 45k

If you earn 45k a year, aim for a monthly rent range of $937.50 to $1,125, in line with the 25-30% of income towards rent guideline.

How Much Rent Can You Afford On 50k

On a 50k yearly income, a prudent monthly rent budget is $1,042 to $1,250, following the standard guideline of allocating 25-30% of income to rent.

How Much Rent Can You Afford On 55k

If you make 55k annually, a monthly rent between $1,146 to $1,375 is sensible, adhering to the 25-30% of income towards housing guideline.

How Much Rent Can You Afford On 60k

With a 60k yearly income, a monthly rent budget between $1,250 to $1,500 is advisable, adhering to the common 25-30% of income for housing expenses guideline.

How Much Rent Can You Afford On 65k

If earning 65k a year, a monthly rent range of $1,354 to $1,625 is reasonable, following the suggested 25-30% of income towards rent guideline.

How Much Rent Can You Afford On 70k

On a 70k annual income, aim for a monthly rent between $1,458 to $1,750, adhering to the 25-30% of income towards housing expenses guideline.

How Much Rent Can You Afford On 75k

If you make 75k a year, a sensible monthly rent range is $1,562 to $1,875, following the standard 25-30% of income for rent guideline.

How Much Rent Can You Afford On 80k

With an 80k yearly income, a monthly rent budget between $1,667 to $2,000 is advisable, aligning with the common 25-30% of income towards housing guideline.

How Much Rent Can You Afford On 85k

If earning 85k annually, a reasonable monthly rent range is $1,771 to $2,125, adhering to the suggested 25-30% of income for housing expenses guideline.

How Much Rent Can You Afford On 90k

On a 90k yearly income, aim for a monthly rent between $1,875 to $2,250, following the standard 25-30% of income towards rent guideline.

How Much Rent Can You Afford On 95k

If you make 95k a year, a prudent monthly rent budget is $1,979 to $2,375, adhering to the 25-30% of income for housing guideline.

How Much Rent Can You Afford On 100k

With a 100k annual income, a monthly rent range of $2,083 to $2,500 is reasonable, following the common 25-30% of income towards rent guideline.

How Much Rent Can You Afford On 110k

If earning 110k a year, a sensible monthly rent budget is $2,292 to $2,750, adhering to the advised 25-30% of income for housing expenses guideline.

How Much Rent Can You Afford On 120k

On a 120k yearly income, aim for a monthly rent between $2,500 to $3,000, following the standard 25-30% of income towards rent guideline.

How Much Rent Can You Afford On 130k

If you make 130k annually, a monthly rent range of $2,708 to $3,250 is advisable, aligning with the common 25-30% of income for housing guideline.

How Much Rent Can You Afford On 150k

With a 150k yearly income, a reasonable monthly rent budget is $3,125 to $3,750, following the suggested 25-30% of income towards housing expenses guideline.

Conclusion

Understanding and calculating rent affordability is a critical step towards a financially stable and comfortable living situation.

Balancing income, expenses, and savings using tools and resources, while also exploring ways to make rent more affordable, empowers you to make informed decisions.

Moreover, being aware of legal protections adds an extra layer of security in your rental journey.

This guide provides a comprehensive outlook on managing rent affordability, aiming to make your next rental experience a positive one.